The post Gold Prices Hover Around $2,334 Amid Strong Dollar and Rising Yields appeared first on GoTrading.Me.

]]>The precious metal has been under pressure due to a robust US dollar and rising bond yields, as investors await key economic data and insights from Federal Reserve officials for further guidance on the future path of US interest rates.

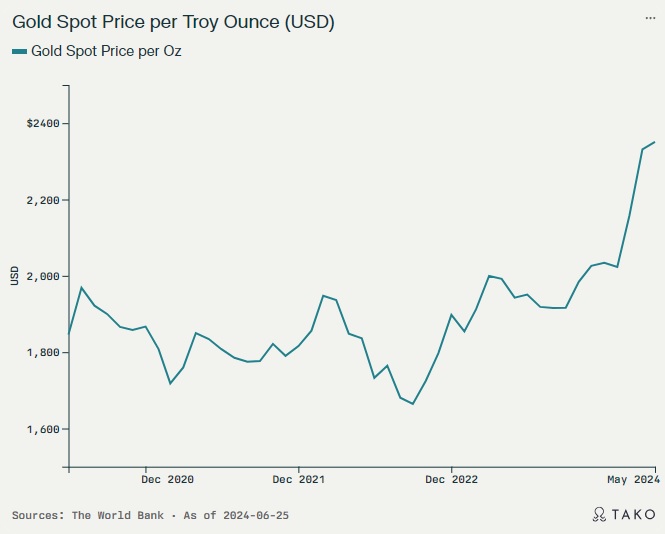

Gold’s Recent Price Action

After experiencing significant losses on Monday, gold has stabilized around the $2,334 mark, with traders closely monitoring market developments and positioning themselves accordingly. The recent price action highlights the sensitivity of the precious metal to changes in the economic landscape and the ongoing uncertainty surrounding monetary policy decisions.

The current spot price of gold stands at $2,330.55 per troy ounce, while the price in Canadian dollars is C$3,185.77 per troy ounce. Despite the recent fluctuations, gold remains a sought-after asset for investors seeking to diversify their portfolios and hedge against potential economic risks.

Factors Influencing Gold Prices

Several key factors have been influencing gold prices in recent trading sessions:

- US Dollar Strength: The US dollar has been displaying strength in the global markets, making gold more expensive for holders of other currencies and potentially limiting demand. The inverse relationship between the US dollar and gold prices is a well-established dynamic in the financial markets.

- Rising Bond Yields: Higher bond yields can make fixed-income investments more attractive compared to non-yielding assets like gold. As bond yields rise, the opportunity cost of holding gold increases, which can lead to a decrease in demand and, consequently, lower prices. The real interest rate has a negative correlation with gold prices, as higher real rates make gold less appealing.

- Inflation Concerns: Investors are closely monitoring inflation data to gauge the potential impact on gold prices. Gold is often considered a hedge against inflation, as it tends to maintain its value over time. The upcoming release of the US core PCE inflation data, the Federal Reserve’s preferred inflation gauge, is expected to provide valuable insights into the current inflationary environment.

- Federal Reserve Commentary: Market participants are eagerly awaiting comments from Federal Reserve officials regarding the future trajectory of US interest rates. Any hints about the timeline for potential rate cuts could significantly impact gold prices, as lower interest rates generally support gold by reducing the opportunity cost of holding non-yielding assets.

Market Expectations and Trading Strategies

As traders and investors navigate the current market conditions, they are focusing on several key aspects:

- US Core PCE Inflation Data: The upcoming release of the US core PCE inflation data is expected to provide crucial insights into the inflationary pressures in the economy. Traders are closely monitoring this data to assess the potential impact on gold prices and adjust their trading strategies accordingly.

- Federal Reserve Comments: Any comments from Federal Reserve officials regarding the future path of interest rates will be carefully scrutinized by market participants. Hints about the timing of potential rate cuts could significantly influence gold prices, as lower rates tend to support the precious metal.

- Technical Analysis: Traders are employing various technical analysis tools to identify key support and resistance levels, as well as potential entry and exit points in the gold market. Analyzing historical price charts, such as those spanning the past 1 day, 3 days, 30 days, 60 days, 1 year, 2 years, 5 years, 10 years, 15 years, 20 years, 30 years, and up to 43 years, can provide valuable insights into long-term trends and market dynamics.

- Risk Management: Given the current market volatility, traders are placing a strong emphasis on risk management strategies. This includes setting appropriate stop-loss orders, managing position sizes, and diversifying their portfolios to mitigate potential losses. Prudent risk management is crucial in navigating the uncertainties surrounding gold prices.

Implications for Forex Traders

For forex traders, the fluctuations in gold prices can have significant implications, particularly when trading currency pairs that are sensitive to changes in the precious metal’s value. Some key considerations for forex traders include:

- USD/XAU Correlation: The US dollar and gold often exhibit an inverse relationship, with a stronger dollar typically leading to lower gold prices and vice versa. Forex traders should closely monitor the USD/XAU pair and consider the impact of gold price movements on their trading strategies.

- Risk Sentiment: Gold is often considered a safe-haven asset, attracting investors during times of economic uncertainty or market turbulence. Changes in risk sentiment can influence gold prices and, consequently, impact forex markets. Traders should stay attuned to shifts in market sentiment and adjust their positions accordingly.

- Commodity Currencies: Currencies of countries with significant gold reserves or mining operations, such as the Australian dollar (AUD), Canadian dollar (CAD), and South African rand (ZAR), can be influenced by fluctuations in gold prices. Forex traders should consider the potential impact of gold price movements on these commodity currencies.

- Inflation and Interest Rates: As gold is often viewed as a hedge against inflation, changes in inflation expectations and interest rate decisions by central banks can affect gold prices and, in turn, impact forex markets. Traders should closely follow economic data releases and central bank communications to gauge the potential implications for gold and currency pairs.

Summary

As gold prices hover around the $2,334 per ounce level, traders and investors are closely monitoring various factors that could influence the precious metal’s future trajectory. The strong US dollar, rising bond yields, upcoming inflation data, and comments from Federal Reserve officials are all key elements that market participants are considering in their decision-making process.

For forex traders, understanding the relationship between gold prices and currency markets is crucial in developing effective trading strategies. By staying informed about economic developments, analyzing historical price charts, and employing prudent risk management techniques, traders can navigate the current market conditions and potentially capitalize on opportunities presented by fluctuations in gold prices.

As always, it is essential for traders to conduct thorough research, stay updated with the latest market news, and exercise caution when making trading decisions. By combining a deep understanding of market dynamics with disciplined trading practices, forex traders can position themselves to effectively navigate the challenges and opportunities presented by the ever-changing financial landscape.

The post Gold Prices Hover Around $2,334 Amid Strong Dollar and Rising Yields appeared first on GoTrading.Me.

]]>The post How to Trade Forex: A Guide for Beginners appeared first on GoTrading.Me.

]]>Forex trading can be a lucrative and exciting way to make money, but it also comes with its own set of risks and challenges.

In this guide, we’ll walk you through the basics of forex trading and provide you with practical tips and strategies to help you get started on your journey to becoming a successful forex trader.

What is Forex Trading?

Forex, short for foreign exchange, is the process of buying and selling currencies on the global market. It is the largest financial market in the world, with a daily trading volume of over $6 trillion.

Unlike the stock market, which has set trading hours, the forex market is open 24 hours a day, five days a week, allowing traders to take advantage of opportunities around the clock.

In forex trading, currencies are always traded in pairs, such as EUR/USD (euro/US dollar) or GBP/JPY (British pound/Japanese yen).

When you buy a currency pair, you are essentially buying the base currency (the first currency listed) and selling the quote currency (the second currency listed). The goal is to profit from the fluctuations in exchange rates between the two currencies.

Why Trade Forex?

There are several reasons why forex trading has become increasingly popular among individual traders:

- Accessibility: With the advent of online trading platforms, anyone with a computer and an internet connection can participate in the forex market. Many brokers offer low minimum account balances and leverage, allowing traders to start with a relatively small amount of capital.

- Liquidity: The forex market is highly liquid, meaning there are always buyers and sellers available to execute trades. This liquidity ensures that traders can enter and exit positions quickly and easily, without significant slippage.

- Volatility: Currency prices are constantly fluctuating due to a variety of factors, including economic news, political events, and market sentiment. This volatility creates opportunities for traders to profit from both rising and falling markets.

- Diversification: Forex trading allows investors to diversify their portfolios beyond traditional assets like stocks and bonds. By trading multiple currency pairs, traders can spread their risk across different markets and take advantage of global economic trends.

Getting Started with Forex Trading

Before you dive into forex trading, it’s important to understand the basics and develop a solid foundation. Here are the key steps to getting started:

1. Educate Yourself

The first step in becoming a successful forex trader is to educate yourself about the market and how it works. There are numerous online resources available, including courses, webinars, and tutorials that can help you learn the fundamentals of forex trading. Some key topics to focus on include:

- Currency pairs: Understand the major, minor, and exotic currency pairs and how they are traded.

- Market analysis: Learn how to analyze the market using technical and fundamental analysis techniques.

- Trading strategies: Familiarize yourself with different trading strategies, such as trend following, range trading, and breakout trading.

- Risk management: Understand the importance of managing risk through proper position sizing, stop-loss orders, and diversification.

2. Choose a Broker

Once you have a basic understanding of forex trading, the next step is to choose a reputable broker. There are many forex brokers available, each with their own unique features and offerings. When selecting a broker, consider the following factors:

- Regulation: Make sure the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US.

- Trading platform: Look for a broker that offers a user-friendly and reliable trading platform, such as MetaTrader 4 or 5.

- Spreads and commissions: Compare the spreads and commissions charged by different brokers to ensure you are getting a competitive deal.

- Customer support: Choose a broker with responsive and knowledgeable customer support, available 24/5.

3. Open a Demo Account

Before risking real money, it’s a good idea to practice trading with a demo account. Most brokers offer free demo accounts that allow you to trade with virtual money in a simulated market environment.

This is a great way to familiarize yourself with the trading platform, test out different strategies, and gain confidence in your trading abilities.

4. Develop a Trading Plan

A trading plan is a written document that outlines your approach to the market, including your goals, risk tolerance, and strategies. Having a well-defined trading plan can help you stay disciplined and focused, even in the face of market volatility. Your trading plan should include:

- Trading style: Determine whether you will be a day trader, swing trader, or position trader.

- Risk management: Set clear rules for managing risk, such as using stop-loss orders and limiting your exposure to any single trade.

- Entry and exit rules: Define the criteria for entering and exiting trades, based on your chosen strategy.

- Position sizing: Determine how much of your account you will risk on each trade, based on your risk tolerance and account size.

5. Start Small and Scale Up

When you’re ready to start trading with real money, it’s important to start small and gradually scale up your position sizes as you gain experience and confidence. Don’t risk more than you can afford to lose, and always adhere to your trading plan.

As you become more comfortable with forex trading, you can begin to explore more advanced strategies and techniques, such as:

- Multiple time frame analysis: Analyzing the market on different time frames (e.g., hourly, daily, weekly) to identify trends and potential entry/exit points.

- Correlation analysis: Understanding how different currency pairs are correlated and using this information to manage risk and identify trading opportunities.

- Sentiment analysis: Using market sentiment indicators, such as the Commitment of Traders (COT) report, to gauge market positioning and potential trend reversals.

Forex Trading Strategies

There are numerous forex trading strategies available, each with its own unique approach to analyzing the market and executing trades. Here are a few popular strategies to consider:

1. Trend Following

Trend following is a strategy that involves identifying the overall direction of the market and taking positions in the direction of the trend. Traders using this strategy will typically use technical analysis tools, such as moving averages and trendlines, to identify the trend and potential entry/exit points.

Example: A trader notices that the EUR/USD pair has been in an uptrend, with prices consistently making higher highs and higher lows. They decide to enter a long position, placing a stop-loss order below the most recent swing low and a take-profit order at a key resistance level.

2. Range Trading

Range trading is a strategy that involves identifying a price range that a currency pair is trading within and taking positions at the support and resistance levels. This strategy works best in markets that are consolidating or lacking a clear trend.

Example: A trader identifies that the GBP/USD pair has been trading between 1.3500 and 1.3700 for the past week. They decide to enter a long position at the support level of 1.3500, with a stop-loss order below the range and a take-profit order at the resistance level of 1.3700.

3. Breakout Trading

Breakout trading is a strategy that involves identifying key levels of support and resistance and taking positions when the price breaks through these levels. This strategy works best in markets that are trending or experiencing high volatility.

Example: A trader notices that the USD/JPY pair has been consolidating below a key resistance level of 110.00. They decide to enter a long position if the price breaks above this level, with a stop-loss order below the most recent swing low and a take-profit order at the next key resistance level.

4. Position Trading

Position trading is a long-term strategy that involves holding positions for weeks or even months, based on fundamental analysis and macroeconomic trends. Traders using this strategy will typically focus on high-impact news events, such as central bank decisions and economic data releases, to inform their trading decisions.

Example: A trader believes that the US economy is likely to outperform the Eurozone over the next few months, based on diverging monetary policy and economic growth prospects. They decide to enter a long position in the USD/EUR pair, with a wide stop-loss and a long-term profit target.

Risk Management in Forex Trading

Risk management is a critical component of successful forex trading. Without proper risk management, even the most profitable trading strategies can lead to significant losses.

Here are some key risk management principles to keep in mind:

- Use Stop-Loss Orders: Always use stop-loss orders to limit your potential losses on any single trade. A stop-loss order is an instruction to your broker to close out your position if the price moves against you by a certain amount.

- Limit Your Exposure: Don’t risk more than 1-2% of your account balance on any single trade. This will help you preserve your capital and avoid large drawdowns.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your risk across multiple currency pairs and trading strategies to reduce your overall exposure to any single market or event.

- Manage Your Leverage: Leverage can be a double-edged sword in forex trading. While it can amplify your profits, it can also magnify your losses. Use leverage responsibly and never risk more than you can afford to lose.

Summary

Forex trading can be a challenging but rewarding endeavor for those willing to put in the time and effort to learn the market and develop a solid trading plan.

By following the steps outlined in this guide and continuously educating yourself about the market, you can increase your chances of success and achieve your financial goals.

Remember, forex trading is not a get-rich-quick scheme. It requires discipline, patience, and a willingness to learn from your mistakes.

Start small, focus on risk management, and never stop learning. With the right mindset and approach, you can become a successful forex trader and take control of your financial future.

Additional Resources

To further your education and stay up-to-date with the latest developments in the forex market, consider the following resources:

- Babypips.com: A comprehensive educational resource for forex traders of all levels, with courses, tutorials, and a supportive community.

- ForexFactory.com: A popular forex news and analysis website, with a calendar of upcoming economic events and a forum for traders to share ideas and strategies.

- TradingView.com: A web-based charting and analysis platform, with a wide range of technical indicators and a social network for traders to collaborate and share ideas.

- Bloomberg.com: A leading source of financial news and analysis, with real-time currency quotes and market insights.

By leveraging these resources and continuously expanding your knowledge, you can stay ahead of the curve and adapt to the ever-changing forex market. Happy trading!

The post How to Trade Forex: A Guide for Beginners appeared first on GoTrading.Me.

]]>The post Understanding Market Structure in Forex Trading appeared first on GoTrading.Me.

]]>By analyzing market structure, traders can gain valuable insights into market behavior and make more informed trading decisions.

Let’s dive deep into the concept of market structure in forex trading. We’ll explore the key components of market structure, how to identify trends and chart patterns, and practical strategies for incorporating market structure analysis into your trading plan.

The Building Blocks of Market Structure

At its core, market structure is composed of several key elements:

- Trends: A trend refers to the overall direction of price movement, which can be bullish (upward), bearish (downward), or sideways. Identifying the prevailing trend is crucial for aligning your trades with the market’s momentum.

- Support and Resistance: Support and resistance levels are price areas where the market has historically struggled to break through. These levels can act as barriers, causing price to bounce off or break through, depending on market sentiment and volume.

- Swing Highs and Lows: Swing highs and lows are the peaks and troughs formed by price action on a chart. They help define the boundaries of a trend and can be used to identify potential entry and exit points.

- Chart Patterns: Recognizable price formations, such as head and shoulders, double tops/bottoms, and triangles, can provide clues about future market direction. These patterns often signal trend continuations or reversals.

By understanding these building blocks, traders can start to piece together a clearer picture of market structure and anticipate potential price movements.

Identifying Trends in Market Structure

Trends are the backbone of market structure analysis. A market can be trending in one of three directions:

- Uptrend (Bullish): Characterized by higher highs and higher lows, an uptrend indicates a period of rising prices. In an uptrend, traders often look for opportunities to buy on dips or breakouts above resistance.

- Downtrend (Bearish): Marked by lower lows and lower highs, a downtrend signifies a period of falling prices. Traders in a downtrend may seek to sell on rallies or breakdowns below support.

- Sideways (Range-bound): When a market is trading within a defined range, with no clear upward or downward trend, it is said to be moving sideways. Range-bound markets often present opportunities for traders to buy at support and sell at resistance.

To identify the prevailing trend, traders can use a combination of technical tools, such as moving averages, trendlines, and momentum indicators.

For example, a simple moving average crossover strategy involves comparing a short-term moving average (e.g., 50-period) with a long-term moving average (e.g., 200-period). When the short-term MA crosses above the long-term MA, it may signal the beginning of an uptrend, while a cross below could indicate a shift to a downtrend.

Trendlines are another useful tool for visualizing trends. By connecting a series of higher lows in an uptrend or lower highs in a downtrend, traders can create a trendline that represents the overall direction of the market. A break above or below the trendline can signal a potential trend change.

Chart Patterns and Market Structure

In addition to trends, chart patterns play a significant role in market structure analysis. These recognizable price formations can provide valuable insights into potential market movements.

Some common chart patterns include:

- Head and Shoulders: A reversal pattern that forms after an uptrend, consisting of a left shoulder, head, and right shoulder. A break below the neckline (the line connecting the lows of the shoulders) can signal a trend reversal.

- Double Tops and Bottoms: Reversal patterns that occur when price tests a resistance (double top) or support (double bottom) level twice, failing to break through. A subsequent break below support or above resistance can confirm the reversal.

- Triangles: Continuation patterns that form during a trend, characterized by converging trendlines. Symmetrical triangles have converging upper and lower trendlines, while ascending and descending triangles have a flat upper or lower trendline, respectively. A breakout from the triangle often signals a continuation of the prevailing trend.

- Flags and Pennants: Continuation patterns that resemble a flag or pennant shape, formed by parallel trendlines. These patterns typically occur after a sharp price move and signal a brief consolidation before the trend resumes.

By recognizing these patterns within the context of the overall market structure, traders can anticipate potential breakouts, reversals, or continuations, and plan their trades accordingly.

Incorporating Market Structure into Your Trading Plan

Understanding market structure is only half the battle; the real challenge lies in effectively incorporating this knowledge into your trading plan. Here are some practical strategies for using market structure analysis in your forex trading:

- Identify the Prevailing Trend: Before entering a trade, assess the overall market trend on multiple timeframes. Look for clear higher highs and higher lows in an uptrend, or lower lows and lower highs in a downtrend. Align your trades with the prevailing trend to increase your chances of success.

- Use Support and Resistance Levels: Identify key support and resistance levels on your charts, and use them to guide your entry and exit decisions. In an uptrend, look for opportunities to buy near support or on a breakout above resistance. In a downtrend, consider selling near resistance or on a breakdown below support.

- Combine Multiple Timeframes: Analyze market structure on different timeframes to gain a more comprehensive view of the market. For example, you may identify the overall trend on a daily chart, then drill down to a 4-hour or 1-hour chart to pinpoint specific entry and exit levels.

- Manage Risk with Stop Losses: Always use stop losses to protect your capital and limit your downside risk. Place your stop loss at a level that invalidates your trade idea, such as below a key support level in a long trade or above a key resistance level in a short trade.

- Adapt to Changing Market Conditions: Market structure is dynamic and can change over time. Be prepared to adjust your trading plan as new trends, patterns, or levels emerge. Regularly review your charts and update your analysis to stay aligned with the current market structure.

Summary

Market structure analysis is a powerful tool for forex traders seeking to make informed trading decisions. By understanding trends, support and resistance levels, and chart patterns, traders can gain valuable insights into market behavior and potential price movements.

However, it’s important to remember that market structure is just one piece of the puzzle. Successful trading also requires a well-defined trading plan, disciplined risk management, and the ability to adapt to changing market conditions.

As you continue your journey as a forex trader, make market structure analysis a core component of your trading approach. Combine it with other technical and fundamental analysis techniques, and continually refine your skills through practice and education.

With dedication, discipline, and a solid understanding of market structure, you’ll be well on your way to navigating the exciting and dynamic world of forex trading.

The post Understanding Market Structure in Forex Trading appeared first on GoTrading.Me.

]]>The post The Forex Advantage: How Liquidity Can Supercharge Your Trading Profits appeared first on GoTrading.Me.

]]>The foreign exchange market, also known as forex or FX, is the largest and most liquid financial market in the world. In this article, we’ll dive into what makes the forex market so massive and liquid compared to other financial markets.

Daily Trading Volume Exceeds $6.6 Trillion

One of the most striking features of the forex market is its sheer size in terms of trading volume.

According to the latest Triennial Central Bank Survey conducted by the Bank for International Settlements (BIS), the average daily turnover in global foreign exchange markets reached $6.6 trillion in April 2019. This figure has grown significantly from the $5.1 trillion daily volume recorded in the previous survey from 2016.

To put this into perspective, let’s compare forex to the stock market. The total value of equities traded on all major stock exchanges worldwide is estimated to be around $200 billion per day.

This means that in just a single trading day, the forex market trades more than 30 times the volume of the global stock market.

The immense liquidity of forex allows for tighter spreads, lower transaction costs, and the ability to open or close even very large positions without significantly impacting market prices.

Decentralized Market Structure

Another key factor contributing to forex’s size and liquidity is its decentralized, over-the-counter (OTC) market structure.

Unlike stock trading which is conducted on centralized exchanges like the NYSE or NASDAQ, forex trading takes place directly between counterparties such as banks, financial institutions, corporations, and individuals. There is no central exchange or clearing house that matches orders or sets prices.

This decentralized nature allows the forex market to operate 24 hours a day, 5 days a week, with trading activity moving seamlessly between major financial centers in different time zones like London, New York, Tokyo, and Sydney.

At any given time, there are buyers and sellers actively trading somewhere in the world, providing constant liquidity. The continuous operation also allows traders to react immediately to economic news and events that occur outside of normal stock market hours.

Diverse Participants and Purposes for Trading

The forex market caters to a wide range of participants with varying objectives, further boosting liquidity:

- Central banks manage their country’s currency reserves and conduct monetary policy through forex operations.

- Commercial and investment banks act as dealers for clients and trade on behalf of the institution.

- Corporations use the forex market to hedge currency risk from international trade or foreign investments.

- Institutional investors like hedge funds and asset managers trade currencies for speculation or to diversify portfolios.

- Retail traders speculate on exchange rate movements or hedge personal foreign currency exposure.

This diversity of players, from massive institutions down to individuals, creates a dynamic market with participants that have different time horizons, strategies, and responses to news/economic data.

Compared to more homogeneous markets dominated by a particular type of investor, this variety contributes to tighter spreads and ample liquidity at all times.

Most Traded Currency Pairs

While the forex market spans a multitude of currencies worldwide, much of the trading volume is concentrated in a handful of major currency pairs:

- EUR/USD (euro vs US dollar)

- USD/JPY (US dollar vs Japanese yen)

- GBP/USD (British pound vs US dollar)

- AUD/USD (Australian dollar vs US dollar)

- USD/CAD (US dollar vs Canadian dollar)

- USD/CNY (US dollar vs Chinese yuan)

- USD/CHF (US dollar vs Swiss franc)

These pairs, especially EUR/USD which accounts for 28% of global forex volume, act as the backbone of the forex market’s liquidity. The deep pool of buyers and sellers trading these pairs at all times allows even large transactions to be executed quickly with minimal slippage.

Additionally, the high liquidity of major pairs makes them less susceptible to manipulation or extreme volatility spikes from an individual trade.

Comparison to the Cryptocurrency Market

As a crypto trader, it’s worth noting how the nascent cryptocurrency market compares to forex in terms of size and liquidity. The total market capitalization of all cryptocurrencies is approximately $1.4 trillion as of April 2023, with daily trading volume averaging around $80-100 billion.

While impressive growth has occurred in recent years, the crypto market is still a fraction of the size of forex. Lower trading volumes mean that cryptocurrency pairs typically have wider spreads and less liquidity than major forex pairs.

The market is also more fragmented, with trading split across hundreds of different exchanges that have varying degrees of liquidity and security.

However, the cryptocurrency market is rapidly evolving and has the potential for continued expansion as more institutional investors enter the space and market infrastructure matures. Innovations like decentralized finance (DeFi) and stablecoins are creating new use cases and avenues for liquidity.

As a multi-asset trader, it’s crucial to stay on top of developments in both forex and crypto markets to capitalize on opportunities.

Importance of Liquidity for Traders

For professional traders, the liquidity of the forex market offers several key advantages:

- Tighter spreads: The abundance of buyers and sellers allows for very competitive bid-ask spreads, reducing transaction costs.

- Faster execution: Orders can be filled quickly without moving the market, ensuring trades are executed at the intended price.

- Ability to scale: Traders can take on larger position sizes without worrying about insufficient counterparties or excessive slippage.

- Efficient price discovery: High liquidity means that prices rapidly adjust to reflect new information, reducing arbitrage opportunities and ensuring fair market value.

- Lower volatility: While still volatile, the deep liquidity of major forex pairs helps to absorb shocks and limit erratic price movements.

As a trader, it’s essential to focus on currency pairs with the highest liquidity that suit your strategy and risk tolerance. Prudent risk management, including proper position sizing and stop-loss discipline, becomes even more crucial when venturing into less liquid pairs or markets.

Summary

The foreign exchange market’s unparalleled size and liquidity make it a unique and attractive arena for professional traders.

With daily volume exceeding $6.6 trillion, a decentralized 24/5 structure, and a diverse mix of participants, the forex market offers the depth and efficiency needed to implement a wide range of trading strategies.

As the world becomes increasingly interconnected and cross-border flows of goods, services, and investments continue to grow, the importance of the forex market in the global financial system will only continue to expand.

By understanding the key drivers of forex’s size and liquidity, traders can more effectively navigate this dynamic marketplace and unlock its vast potential.

The post The Forex Advantage: How Liquidity Can Supercharge Your Trading Profits appeared first on GoTrading.Me.

]]>The post Market Reactions to Economic Data and Central Bank Announcements appeared first on GoTrading.Me.

]]>In this article, we will explore the recent market reactions to key economic data and central bank announcements, focusing on the U.S. dollar and its response to jobless claims data and Federal Reserve Chair Jerome Powell’s speech.

U.S. Jobless Claims and Market Impact

Recent data from the U.S. Department of Labor showed that initial jobless claims rose by 9,000 to 221,000 for the week ending June 15, 2024. This increase in jobless claims has implications for the upcoming non-farm payroll report, which is a critical indicator of the U.S. labor market’s health.

Despite the rise in jobless claims, the U.S. dollar initially strengthened. This reaction can be attributed to the fact that the increase was not as significant as some market participants had feared.

Additionally, continued jobless claims, which provide a broader view of unemployment trends, showed a slight decrease, suggesting that the labor market is not deteriorating rapidly.

Federal Reserve Chair Jerome Powell’s Speech

Federal Reserve Chair Jerome Powell’s recent speech provided further insights into the central bank’s stance on monetary policy. Powell emphasized that while the Federal Reserve supports rate cuts, more evidence of cooling inflation is needed before any action is taken. This cautious approach reflects the Fed’s commitment to achieving its 2% inflation target.

Powell’s comments had a mixed impact on the market.

On one hand, the acknowledgment of potential rate cuts provided some support to the U.S. dollar. On the other hand, the insistence on more evidence of cooling inflation before making any changes created uncertainty among traders, leading to cautious market behavior.

Economic Data and Central Bank Announcements

The Federal Reserve’s decision to maintain the current interest rates at 5.25% to 5.5% was influenced by recent economic data, including the Consumer Price Index (CPI) and Producer Price Index (PPI) reports.

The CPI for May showed a slight decrease in monthly inflation, while the year-over-year figure remained steady at 3.4%. The PPI also indicated a decrease in the monthly rate, suggesting some easing of inflationary pressures.

Despite these positive signs, the Federal Reserve remains cautious. Powell highlighted the need for sustained progress towards the 2% inflation target before considering rate cuts. This stance reflects the central bank’s commitment to controlling inflation and ensuring economic stability

Global Market Reactions

The U.S. dollar’s movements have broader implications for global markets. For instance, non-U.S. central banks, which had previously cut rates, welcomed the news of potential U.S. rate cuts. This development reduced concerns about capital outflows and currency depreciation, providing some relief to these economies.

In the Philippines, the forex market closely monitors U.S. economic data and Federal Reserve announcements. The U.S. dollar’s strength or weakness can impact the Philippine peso, influencing import and export prices, inflation, and overall economic stability.

Traders in the Philippines need to stay informed about these developments to make informed trading decisions.

Summary

The forex market’s reaction to economic data and central bank announcements underscores the importance of staying informed and adaptable. Recent U.S. jobless claims data and Federal Reserve Chair Jerome Powell’s speech have highlighted the delicate balance between supporting economic growth and controlling inflation.

As traders, it is crucial to monitor these events closely and adjust strategies accordingly.

By understanding the implications of economic data and central bank policies, traders can navigate the forex market more effectively.

Staying informed and maintaining a disciplined approach to trading will help manage risks and capitalize on opportunities in this dynamic market.

Sources:

- XTB Research, Bureau of Labor Statistics (BLS), Macrobond

- U.S. News & World Report

- Deloitte Global Economic Update

- Federal Reserve Meeting Reports

- Reuters Market Analysis

The post Market Reactions to Economic Data and Central Bank Announcements appeared first on GoTrading.Me.

]]>The post Beginners’ Guide to Buying and Selling Currency Pairs in Forex appeared first on GoTrading.Me.

]]>Understanding Forex Trading

Forex, short for foreign exchange, is a global market where currencies are traded 24 hours a day, five days a week. It’s the largest financial market in the world, with a daily trading volume of over $7.5 trillion. The goal of forex trading is to profit from the fluctuations in exchange rates between different currencies.

Unlike stock markets, forex trading doesn’t take place on a centralized exchange. Instead, transactions are conducted electronically over-the-counter (OTC) through a network of banks, financial institutions, and individual traders.

Currency Pairs Explained

In forex trading, currencies are always traded in pairs. A currency pair represents the value of one currency relative to another. For example, the EUR/USD pair represents the value of the Euro against the US Dollar. If the EUR/USD exchange rate is 1.20, it means that one Euro is worth 1.20 US Dollars.

The first currency in a pair is called the base currency, while the second is known as the quote currency. When you buy a currency pair, you are buying the base currency and selling the quote currency. Conversely, when you sell a pair, you are selling the base currency and buying the quote currency.

Major Currency Pairs

There are several categories of currency pairs, but the most actively traded are the “major” pairs. These include:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- USD/CAD (US Dollar/Canadian Dollar)

- AUD/USD (Australian Dollar/US Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

Major pairs are the most liquid and heavily traded in the forex market, accounting for the majority of the trading volume. They typically have lower spreads and are less volatile compared to other pairs.

Cross Currency Pairs and Exotics

In addition to the majors, there are also cross currency pairs, which don’t include the US Dollar. Examples include EUR/GBP, GBP/JPY, and EUR/CHF. These pairs are less liquid than the majors but still widely traded.

Exotic currency pairs involve a major currency paired with the currency of an emerging economy, such as USD/SGD (US Dollar/Singapore Dollar) or JPY/NOK (Japanese Yen/Norwegian Krone). Exotics are less liquid, have higher spreads, and are more volatile.

How to Buy and Sell Currency Pairs

Now that you understand the basics of currency pairs, let’s look at how to actually buy and sell them:

- Choose a forex broker: To trade forex, you’ll need to open an account with a reputable broker. Look for a broker that is regulated, offers competitive spreads, and provides a user-friendly trading platform.

- Decide on a trading strategy: Develop a trading plan based on your goals, risk tolerance, and market analysis. This could involve technical analysis, fundamental analysis, or a combination of both.

- Determine your position size: Calculate how much of your account balance you’re willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% per trade.

- Place your trade: Once you’ve identified a trading opportunity, place your order with your broker. Specify the currency pair, your position size, and whether you want to buy or sell.

- Manage your trade: After opening your position, monitor the market and adjust your trade as needed. Use stop-loss orders to limit potential losses and take-profit orders to lock in gains.

- Close your trade: To close a trade, you simply place an order in the opposite direction of your original trade. So if you bought a currency pair, you would sell it to close the position and vice versa.

Popular Forex Trading Strategies for Beginners

As a beginner, it’s important to focus on simple, easy-to-understand trading strategies. Here are three popular strategies that can be effective for new traders:

1. Breakout Strategy

The breakout strategy involves identifying key price levels, such as support and resistance, and waiting for the price to “break out” of these levels before entering a trade. The idea is that when the price breaks through a significant level, it’s likely to continue moving in that direction.

To trade breakouts, you can use tools like trend lines, moving averages, and chart patterns to identify potential breakout points. Once the price breaks out, you enter a trade in the direction of the breakout and set a stop-loss order just below the breakout level (for a long trade) or above it (for a short trade).

2. Moving Average Crossover Strategy

The moving average crossover strategy uses two moving averages, typically a short-term and a long-term one, to generate buy and sell signals. When the short-term moving average crosses above the long-term one, it’s a buy signal. Conversely, when the short-term moving average crosses below the long-term one, it’s a sell signal.

For example, you could use a 10-period and a 20-period moving average. When the 10-period MA crosses above the 20-period MA, you’d buy the currency pair. When the 10-period MA crosses below the 20-period MA, you’d sell.This strategy works best in trending markets, as it helps you identify the overall direction of the trend and enter trades in that direction.

3. Carry Trade Strategy

The carry trade strategy involves buying a high-yielding currency and selling a low-yielding one to profit from the interest rate differential. The idea is to earn the difference in interest rates between the two currencies while also potentially benefiting from any appreciation in the high-yielding currency.For example, if the Australian dollar has a higher interest rate than the Japanese yen, you could buy AUD/JPY to earn the interest rate differential. You’d hold the trade as long as the interest rate differential remains favorable and the currency pair is trending upwards.

Carry trades work best in a low-volatility environment, as high volatility can quickly erase any gains from the interest rate differential. It’s also important to monitor economic and political developments that could impact the currencies you’re trading.

Risk Management for Beginners

Effective risk management is crucial for success in forex trading, especially for beginners. Here are some key risk management principles to keep in mind:

- Use stop-loss orders: Always use stop-loss orders to limit your potential losses on each trade. A stop-loss is an order to automatically close your trade if the price moves against you by a certain amount.

- Risk a small percentage of your account: Don’t risk more than 1-2% of your account balance on any single trade. This helps ensure that even if you have a losing trade, it won’t significantly impact your overall account.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your risk across multiple currency pairs and trading strategies to minimize the impact of any single losing trade.

- Avoid overtrading: Don’t feel like you need to constantly be in the market. Only enter trades when there’s a clear opportunity that aligns with your trading plan. Overtrading can lead to poor decision-making and increased losses.

- Manage your emotions: Don’t let fear, greed, or other emotions influence your trading decisions. Stick to your trading plan and rely on objective analysis rather than emotional impulses.

Continuous Learning and Improvement

Becoming a successful forex trader is an ongoing process that requires continuous learning and improvement. Here are some tips to help you stay on top of your game:

- Stay informed: Keep up with the latest economic news, market analysis, and trading strategies. Read forex blogs, watch educational videos, and attend webinars to expand your knowledge.

- Practice with a demo account: Before risking real money, practice your trading strategies with a demo account. This allows you to test your skills and build confidence without the pressure of potential losses.

- Learn from your mistakes: Keep a trading journal to track your trades, including your rationale, entry and exit points, and results. Review your journal regularly to identify your strengths and weaknesses and learn from your mistakes.

- Seek mentorship: Consider finding a mentor or joining a trading community to learn from more experienced traders. They can provide valuable insights, feedback, and support as you develop your skills.

- Adapt to changing market conditions: Markets are constantly evolving, so be prepared to adapt your strategies as needed. Stay flexible and open-minded, and be willing to adjust your approach based on changing market dynamics.

Summary

Buying and selling currency pairs is at the core of forex trading. By understanding how pairs work, developing a solid trading strategy, and managing your risk, you can navigate the dynamic forex market and potentially profit from exchange rate fluctuations.

Remember, forex trading involves significant risk and is not suitable for everyone. Never trade with money you can’t afford to lose and always prioritize your education and risk management. With dedication, discipline, and continuous learning, you can develop the skills to become a successful forex trader over time.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Forex trading carries a high level of risk and may not be suitable for all investors. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

The post Beginners’ Guide to Buying and Selling Currency Pairs in Forex appeared first on GoTrading.Me.

]]>The post Understanding Currency Pairs: The Foundation of Forex Trading appeared first on GoTrading.Me.

]]>For anyone looking to venture into the exciting world of forex trading, understanding currency pairs is crucial. Currency pairs form the foundation of all forex trades, and having a solid grasp of how they work is essential for making informed trading decisions.

What is a Currency Pair?

A currency pair is a quotation of two different currencies, where the value of one currency is expressed in terms of the other. In forex trading, currencies are always traded in pairs, such as EUR/USD or USD/JPY.

The first currency listed in a pair is known as the base currency, while the second currency is called the quote or counter currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

Currency pairs are written with the base currency first, followed by the quote currency, separated by a forward slash. The price of the pair represents how much of the quote currency is needed to buy one unit of the base currency.

Types of Currency Pairs

Forex currency pairs are categorized into three main types: major pairs, minor pairs (also known as crosses), and exotic pairs.

Major Pairs

The major currency pairs are the most widely traded pairs in the forex market. They include:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

These pairs are considered majors because they include the US dollar, which is the world’s reserve currency, and they represent the largest and most stable economies globally. Major pairs account for about 75% of all forex trades.

Minor Pairs (Crosses)

Minor currency pairs, also referred to as crosses, are pairs that do not include the US dollar. Some examples are:

- EUR/GBP (Euro/British Pound)

- EUR/JPY (Euro/Japanese Yen)

- GBP/JPY (British Pound/Japanese Yen)

While not as heavily traded as the majors, minor pairs still have significant market liquidity and offer diverse trading opportunities. They are called crosses because the exchange rate is calculated by crossing the exchange rates of the respective currencies against the US dollar.

Exotic Pairs

Exotic currency pairs consist of one major currency paired with the currency of an emerging or smaller economy, such as:

- USD/SGD (US Dollar/Singapore Dollar)

- USD/HKD (US Dollar/Hong Kong Dollar)

Exotic pairs are less liquid compared to major and minor pairs, and they often have wider spreads and higher volatility. Trading exotic pairs carries more risk due to the inherent instability and unpredictability of the smaller economies involved.

Reading and Interpreting Currency Pairs

To effectively trade forex, it’s essential to know how to read and interpret currency pair quotations. Exchange rates express the value of one currency in terms of another, and they are typically quoted to four decimal places.

When looking at a forex quote, the price on the left is the bid price, which is the price at which you can sell the base currency. The price on the right is the ask price, which is the price at which you can buy the base currency.

The difference between the bid and ask price is called the spread, and it represents the cost of making the trade. Spreads are measured in pips, which is the smallest unit of price movement in forex. A pip is usually the last decimal place of a price quote.

For example, if the EUR/USD pair is quoted as 1.1404/1.1405, the bid price is 1.1404, and the ask price is 1.1405. The spread is 1 pip (0.0001).

Factors Affecting Currency Pairs

Various factors can influence the movement and value of currency pairs. Some of the key drivers include:

Economic Data Releases. Economic indicators such as GDP, inflation rates, employment figures, and trade balances can significantly impact currency prices. Positive data tends to strengthen a currency, while negative data can weaken it.

Political Events. Political stability, elections, policy changes, and geopolitical tensions can all affect currency values. Uncertainty or instability in a country often leads to a weaker currency.

Interest Rates. Interest rate differentials between countries can influence currency exchange rates. Higher interest rates typically attract foreign investment, increasing demand for the currency and causing it to appreciate.

Market Sentiment. The overall sentiment or perception of the market towards a particular currency can drive its value up or down. Factors such as risk appetite, speculation, and investor confidence play a role in market sentiment.

Summary

Understanding currency pairs is the first step towards becoming a successful forex trader. By familiarizing yourself with the different types of pairs, how to read and interpret them, and the various factors that influence their movements, you’ll be better equipped to navigate the dynamic world of forex trading.

Remember, education is key when it comes to trading. Take the time to learn about fundamental and technical analysis, risk management, and trading psychology. Seek out reputable resources, such as educational courses, webinars, and trading communities, to continually expand your knowledge and skills.

With dedication, discipline, and a solid understanding of currency pairs, you’ll be well on your way to making informed trading decisions and potentially profiting from the exciting opportunities the forex market has to offer.

The post Understanding Currency Pairs: The Foundation of Forex Trading appeared first on GoTrading.Me.

]]>The post Standard Chartered Poised to Launch Spot Crypto Trading Desk appeared first on GoTrading.Me.

]]>Integrating Crypto Trading into Traditional Banking

Standard Chartered’s decision to launch a dedicated crypto trading desk is a strategic response to the increasing demand from institutional clients who are eager to trade these digital assets. The bank’s approach is to seamlessly integrate the crypto trading operation within its existing foreign exchange (FX) unit, leveraging the expertise and infrastructure already in place.

By housing the crypto desk within the FX division, Standard Chartered aims to provide a familiar and accessible avenue for institutional clients to engage with cryptocurrencies. This integration also allows the bank to capitalize on the potential synergies between traditional fiat currencies and digital assets, offering clients a comprehensive suite of trading services.

London: The Hub of Standard Chartered’s Crypto Operations

Standard Chartered has chosen London as the base for its crypto trading desk, which is a testament to the city’s status as a global financial center. London has long been a hub for traditional finance, and in recent years, it has also emerged as a hotbed for fintech innovation and cryptocurrency adoption.

By establishing the crypto desk in London, Standard Chartered can tap into the city’s pool of talent, regulatory clarity, and infrastructure. This strategic location also positions the bank to serve a diverse range of institutional clients from across Europe and beyond, who are increasingly looking to gain exposure to cryptocurrencies.

Meeting Institutional Demand for Crypto Exposure

The launch of Standard Chartered’s spot crypto trading desk is a direct response to the growing appetite among institutional investors for cryptocurrency exposure. As Bitcoin and Ethereum have gained mainstream recognition and acceptance, more institutions are seeking ways to incorporate these digital assets into their portfolios.

Standard Chartered’s move into crypto trading signifies a shift in the perception of cryptocurrencies within the traditional banking sector. By offering a regulated and trusted platform for institutions to trade Bitcoin and Ethereum, the bank is validating the legitimacy of these digital assets and paving the way for greater institutional adoption.

Navigating Regulatory Landscape

One of the key challenges for traditional financial institutions entering the cryptocurrency space is navigating the complex and evolving regulatory landscape. Standard Chartered has been proactively engaging with regulators to ensure that its crypto trading desk operates within the bounds of existing regulations and compliance standards.

The bank’s collaboration with regulators demonstrates its commitment to providing a secure and compliant trading environment for its institutional clients. By working closely with regulatory authorities, Standard Chartered can help shape the future of cryptocurrency regulation and contribute to the development of a more robust and sustainable digital asset ecosystem.

Implications for the Future of Crypto Adoption

Standard Chartered’s entry into the spot crypto trading market represents a significant milestone in the mainstream adoption of cryptocurrencies. As one of the first global banks to offer direct trading of Bitcoin and Ethereum, Standard Chartered is setting a precedent that other financial institutions may follow.

The launch of the crypto trading desk could trigger a domino effect, with more banks and financial institutions recognizing the potential of cryptocurrencies and seeking to offer similar services to their clients. This increased institutional participation could lead to greater liquidity, stability, and legitimacy for the cryptocurrency market as a whole.

Moreover, Standard Chartered’s move could help bridge the gap between traditional finance and the crypto world, fostering greater collaboration and innovation. As banks and crypto companies work together to develop new products and services, we may see the emergence of hybrid financial instruments that combine the benefits of both traditional and digital assets.

Summary

Standard Chartered’s impending launch of a spot crypto trading desk marks a significant step forward in the mainstream adoption of cryptocurrencies. By integrating crypto trading into its FX unit and establishing the desk in London, the bank is well-positioned to meet the growing demand from institutional clients for exposure to Bitcoin and Ethereum.

As more financial institutions follow suit and embrace cryptocurrencies, we can expect to see a more mature and regulated digital asset ecosystem emerge. This development bodes well for the future of cryptocurrencies, as increased institutional participation could drive innovation, liquidity, and stability in the market.

For traders and investors, Standard Chartered’s move into crypto trading presents new opportunities to access these digital assets through a trusted and regulated platform. As the cryptocurrency market continues to evolve and mature, it will be exciting to see how traditional finance and the crypto world converge to shape the future of money and finance.

The post Standard Chartered Poised to Launch Spot Crypto Trading Desk appeared first on GoTrading.Me.

]]>The post Forex Trading for Beginners appeared first on GoTrading.Me.

]]>Forex, short for foreign exchange, is the global market where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume exceeding $6 trillion. In the forex market, traders buy and sell currency pairs, simultaneously buying one currency while selling another. The goal is to profit from fluctuations in exchange rates.

One unique aspect of the forex market is that it operates 24 hours a day, 5 days a week. Trading begins with the opening of the market in Sydney, followed by Tokyo, London, and New York. This around-the-clock activity allows traders to react to news and events as they happen, regardless of their location.

History of Forex

The modern forex market as we know it today has its roots in the Bretton Woods system established in 1944. This system fixed exchange rates to the U.S. dollar, which was pegged to gold. However, in 1971, the U.S. abandoned the gold standard, leading to the free-floating exchange rates we have today.

In the 1980s and 1990s, technological advancements like electronic trading platforms and the internet made forex trading more accessible to retail traders. Previously, forex was dominated by large banks and institutional investors. Today, anyone with a computer and an internet connection can participate in the forex market.

Basic Concepts

To navigate the forex market, beginners must understand several key concepts:

Currency Pairs: Forex trading always involves buying one currency and selling another simultaneously. Currencies are traded in pairs, such as EUR/USD (Euro/U.S. Dollar), GBP/JPY (British Pound/Japanese Yen), or USD/CAD (U.S. Dollar/Canadian Dollar). The first currency listed is the base currency, while the second is the quote currency.

Pips: A pip (percentage in point) is the smallest unit of price movement in forex. For most currency pairs, a pip is equal to 0.0001, except for Japanese yen pairs, where a pip equals 0.01.

Bid/Ask Price: The bid price is the price at which you can sell a currency pair, while the ask price is the price at which you can buy it. The difference between the bid and ask price is called the spread, which is how brokers make money.

Leverage and Margin: Leverage allows traders to control larger positions with a smaller amount of capital. For example, if a broker offers 100:1 leverage, a trader can control a $100,000 position with just $1,000. However, leverage amplifies both profits and losses. Margin is the amount of money required to open and maintain a leveraged position.

How Forex Trading Works

The mechanics of placing a forex trade involve several steps:

- Choosing a Currency Pair: Traders must decide which currency pair they want to trade based on their market analysis and trading strategy.

- Deciding to Buy or Sell: If a trader believes the base currency will appreciate against the quote currency, they will buy the pair (going long). If they think the base currency will depreciate, they will sell the pair (going short).

- Entering the Trade Size: Traders must calculate the appropriate position size based on their account balance and risk tolerance. Risk management is crucial in forex trading.

- Setting Stop-Loss and Take-Profit Levels: Stop-loss orders are used to limit potential losses if the market moves against the trader’s position. Take-profit orders lock in profits when the market moves favorably. These orders help manage risk and emotions.

- Executing and Monitoring the Trade: Once the trade is placed, traders must monitor price action and adjust their positions as needed based on market conditions and their trading plan.

There are different types of trading orders, such as market orders (executed at the current market price) and limit orders (executed at a specified price or better). Traders also employ various styles, like day trading (opening and closing positions within a single trading day) or swing trading (holding positions for several days or weeks).

What Moves the Forex Market

Several key factors drive exchange rates in the forex market:

- Economic Data Releases: Economic indicators such as GDP, inflation, and employment figures can significantly impact currency prices. Strong economic growth and rising inflation typically lead to higher interest rates, which can attract foreign investment and boost demand for a currency.

- Interest Rate Decisions: Central banks set interest rates to manage inflation and stimulate economic growth. Higher interest rates tend to strengthen a currency, as investors seek higher yields. Conversely, lower rates can weaken a currency.

- Geopolitical Events: Political instability, elections, and international trade relations can all influence currency prices. For example, uncertainty surrounding Brexit has led to volatility in the British pound.

- Market Sentiment: Trader psychology and risk appetite play a crucial role in forex. Bullish or bearish sentiment can create self-fulfilling prophecies and exaggerate currency moves.

To make informed trading decisions, forex traders must stay attuned to financial news, economic calendars, and market analysis.

Getting Started with Forex Trading

For beginners looking to start their forex journey, here are some actionable steps:

- Educate Yourself: Before risking real money, invest time in learning about forex through books, online courses, webinars, and educational articles. Understand the basics of how the market works, different trading strategies, and risk management principles.

- Choose a Broker and Platform: Research and compare forex brokers to find one that is reputable, regulated, and offers competitive spreads and trading conditions. Make sure the broker provides a user-friendly trading platform with the tools and features you need.

- Practice with a Demo Account: Most brokers offer demo accounts that allow you to trade with virtual money in real market conditions. Take advantage of this opportunity to familiarize yourself with the trading platform, test strategies, and build confidence before going live.

- Develop a Trading Plan: Create a written trading plan that outlines your goals, risk tolerance, strategies, and rules for entering and exiting trades. A well-defined plan helps maintain discipline and avoid emotional decision-making.

- Start Small and Manage Risk: When you start live trading, begin with small position sizes and focus on preserving your capital. Risk only a small percentage of your account on each trade (e.g., 1-2%) and always use stop-loss orders.

- Keep a Trading Journal: Document your trades, including your rationale, emotions, and lessons learned. Regularly review your journal to identify strengths, weaknesses, and areas for improvement in your trading approach.

Resources for Learning More

To further your forex education, explore these valuable resources:

Books:

- “Currency Trading for Dummies” by Kathleen Brooks and Brian Dolan

- “The Art of Currency Trading” by Brent Donnelly

- “Japanese Candlestick Charting Techniques” by Steve Nison

Online Courses and Tutorials:

- Babypips.com – Comprehensive forex education with free courses and quizzes

- Udemy.com – Wide selection of forex trading courses for all levels

- YouTube – Educational videos and webinars from experienced traders

Websites and Blogs:

- DailyFX.com – News, analysis, and educational articles

- ForexFactory.com – Economic calendar, trading forums, and market coverage

- FXStreet.com – Real-time news, technical analysis, and trading tools

Demo Accounts:

- MetaTrader 4/5 – Popular trading platforms offered by many brokers

- cTrader – Intuitive platform with advanced charting and automation features

- TradingView – Charting and social trading platform with a free demo

Forums and Communities:

- Reddit.com/r/Forex – Active forum for forex discussion and idea sharing

- ForexPeaceArmy.com – Reviews of brokers and trading systems, member forums

- MyFXBook.com – Forex social network to connect with other traders

Remember, becoming a successful forex trader takes time, dedication, and continuous learning. Start with a solid foundation of knowledge, develop a disciplined approach, and never stop educating yourself about the ever-changing market dynamics. With the right mindset and tools, you can navigate the exciting world of forex trading.

The post Forex Trading for Beginners appeared first on GoTrading.Me.

]]>The post What is Forex? appeared first on GoTrading.Me.

]]>This market is decentralized, meaning it has no central physical location, and transactions are conducted electronically over-the-counter (OTC).

Understanding the Forex Market

The forex market is a global marketplace where currencies are traded.

It is essential for international trade and investment, as it allows businesses to convert one currency into another.

The market is highly dynamic, with prices constantly fluctuating due to various factors such as economic indicators, geopolitical events, and market sentiment.

Key Features of the Forex Market

- Decentralized Nature: Unlike stock markets, the forex market has no central exchange. It operates through a network of banks, brokers, and financial institutions.

- 24-Hour Trading: The market is open 24 hours a day, starting from Sunday evening to Friday night. This continuous operation is due to the different time zones of major financial centers around the world.

- High Liquidity: With a daily trading volume exceeding $7.5 trillion, the forex market is the most liquid market globally. This high liquidity ensures that large transactions can be executed with minimal price impact.

How Forex Trading Works

Forex trading involves buying one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (euro/US dollar) or GBP/JPY (British pound/Japanese yen).

The first currency in the pair is the base currency, and the second is the quote currency. The price of a currency pair represents how much of the quote currency is needed to buy one unit of the base currency.

Types of Forex Markets

- Spot Market: The spot market involves the immediate exchange of currencies at the current exchange rate. Transactions are typically settled within two business days.

- Forward Market: In the forward market, contracts are made to buy or sell currencies at a future date at a predetermined rate. These contracts are customized and traded OTC.

- Futures Market: Similar to the forward market, futures contracts are standardized and traded on exchanges. They specify the amount of currency to be exchanged on a specific future date.

Participants in the Forex Market

The forex market comprises various participants, including:

- Commercial Banks: Major banks conduct large volumes of forex transactions on behalf of their clients and for their own accounts.

- Central Banks: Central banks intervene in the forex market to stabilize or increase the value of their national currency.

- Corporations: Businesses engage in forex trading to hedge against currency risk and to pay for goods and services in foreign currencies.

- Retail Traders: Individual investors participate in the forex market through online trading platforms, seeking to profit from currency fluctuations.

How to Start Forex Trading

Starting forex trading involves several steps:

- Learn the Basics: Familiarize yourself with forex terminology, market operations, and trading strategies.

- Choose a Broker: Select a reputable forex broker that offers a user-friendly trading platform, competitive spreads, and robust customer support.

- Open a Trading Account: Register for a trading account with your chosen broker. Most brokers offer demo accounts for practice.

- Develop a Trading Strategy: Create a trading plan that includes your risk tolerance, trading goals, and preferred trading style.

- Practice with a Demo Account: Use a demo account to practice trading without risking real money. This helps you gain experience and test your strategies.

- Start Trading with Real Money: Once you feel confident, start trading with a live account. Begin with small positions and gradually increase your trade size as you gain experience.

Forex Trading Strategies

Successful forex trading requires a well-defined strategy. Here are some common strategies used by traders:

- Technical Analysis: This involves analyzing price charts and using technical indicators to identify trading opportunities. Common tools include moving averages, trend lines, and oscillators.

- Fundamental Analysis: Traders analyze economic indicators, such as GDP, employment data, and interest rates, to predict currency movements. This approach focuses on the underlying economic factors that influence currency values.

- Sentiment Analysis: This strategy involves gauging market sentiment to determine whether traders are bullish or bearish on a particular currency. Sentiment indicators, such as the Commitment of Traders (COT) report, are used to assess market sentiment.

- Scalping: Scalpers aim to make small profits from numerous trades throughout the day. This strategy requires quick decision-making and a high level of discipline.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from short- to medium-term price movements. This strategy involves identifying trends and trading within those trends.

Risk Management in Forex Trading

Risk management is crucial in forex trading to protect your capital and minimize losses. Here are some key risk management techniques:

- Use Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Determine the appropriate size of each trade based on your risk tolerance and account size. Avoid risking more than a small percentage of your capital on a single trade.

- Diversification: Spread your investments across different currency pairs to reduce risk. Diversification helps mitigate the impact of adverse movements in any single currency pair.

- Leverage Management: While leverage can amplify profits, it also increases the risk of significant losses. Use leverage cautiously and be aware of its potential impact on your trading account.

Pros and Cons of Forex Trading

Pros

- High Liquidity: The forex market’s high liquidity ensures that trades can be executed quickly and at desired prices.

- 24-Hour Market: The continuous operation of the forex market allows traders to react to news and events in real-time.

- Low Entry Barriers: Forex trading requires relatively low initial capital, making it accessible to individual investors.

- Leverage: Forex brokers offer high leverage, allowing traders to control larger positions with a smaller amount of capital.

Cons

- High Volatility: The forex market is highly volatile, leading to significant price fluctuations. This volatility can result in substantial losses.

- Complexity: Forex trading involves understanding various factors that influence currency prices, making it complex for beginners.

- Risk of Fraud: The decentralized nature of the forex market makes it susceptible to fraudulent activities. It is essential to choose a reputable broker.

- Emotional Stress: The fast-paced nature of forex trading can lead to emotional stress and impulsive decision-making.

Advanced Forex Trading Concepts

Leverage and Margin

Leverage allows traders to control a large position with a relatively small amount of capital. For example, a leverage ratio of 100:1 means that for every $1 of capital, a trader can control $100 in the market.

While leverage can amplify profits, it also increases the potential for significant losses. Margin is the amount of money required to open a leveraged position. It acts as a security deposit to cover potential losses.

Hedging

Hedging is a strategy used to protect against potential losses by taking an offsetting position in a related asset. In forex trading, hedging can involve taking positions in different currency pairs that are correlated.

For example, if a trader is long on EUR/USD, they might hedge by taking a short position in GBP/USD.

Carry Trade

A carry trade involves borrowing money in a currency with a low-interest rate and investing it in a currency with a higher interest rate.

The goal is to profit from the difference in interest rates, known as the “carry.” This strategy can be profitable in stable market conditions but carries the risk of significant losses if exchange rates move against the trader.

Forex Trading Tools and Resources

Trading Platforms

Forex trading platforms are software applications that allow traders to execute trades, analyze market data, and manage their accounts.

Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

These platforms offer a range of tools and features, such as charting capabilities, technical indicators, and automated trading options.

Economic Calendars

An economic calendar is a tool that provides information on upcoming economic events and data releases.

These events can significantly impact currency prices, and traders use economic calendars to stay informed and plan their trades accordingly. Key events include central bank meetings, employment reports, GDP releases, and inflation data.

News Feeds

Staying updated with the latest market news is crucial for forex traders. News feeds provide real-time information on economic developments, geopolitical events, and market sentiment.

Popular news sources for forex traders include Bloomberg, Reuters, and Forex Factory.

Forex Trading Psychology

Successful forex trading requires not only technical and fundamental analysis skills but also a strong understanding of trading psychology.

Emotions such as fear, greed, and overconfidence can lead to impulsive decisions and significant losses. Here are some tips for maintaining a healthy trading mindset:

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Manage Stress: Trading can be stressful, especially during periods of high volatility. Practice stress management techniques such as meditation, exercise, and taking breaks.

- Accept Losses: Losses are a natural part of trading. Accept them as learning experiences and avoid letting them affect your future decisions.

- Stay Informed: Continuously educate yourself about the forex market and stay updated with the latest news and developments.

Trader Psychology Tips

Know Yourself

If you want to master the psychology of trading, the first step is to know yourself. In other words, you need to be self-aware. You need to know what triggers you subconsciously to react, behave, or take certain actions.

Get to know yourself enough to know when you are wrong, and to admit your mistakes. You need to be able to take a hard look in the mirror and embrace your flaws.