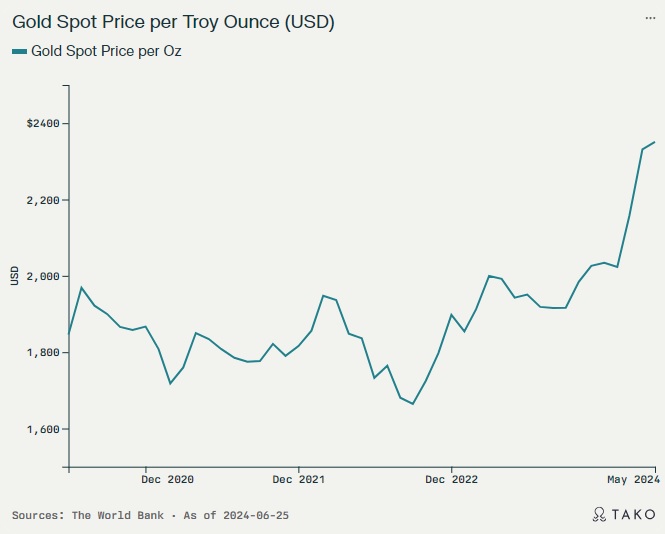

Gold Prices Hover Around $2,334 Amid Strong Dollar and Rising Yields

Gold prices have been trading in a tight range around the $2,334 per ounce level since the start of the week, following a sharp decline of over 1% in the previous session.

The precious metal has been under pressure due to a robust US dollar and rising bond yields, as investors await key economic data and insights from Federal Reserve officials for further guidance on the future path of US interest rates.

Gold’s Recent Price Action

After experiencing significant losses on Monday, gold has stabilized around the $2,334 mark, with traders closely monitoring market developments and positioning themselves accordingly. The recent price action highlights the sensitivity of the precious metal to changes in the economic landscape and the ongoing uncertainty surrounding monetary policy decisions.

The current spot price of gold stands at $2,330.55 per troy ounce, while the price in Canadian dollars is C$3,185.77 per troy ounce. Despite the recent fluctuations, gold remains a sought-after asset for investors seeking to diversify their portfolios and hedge against potential economic risks.

Factors Influencing Gold Prices

Several key factors have been influencing gold prices in recent trading sessions:

- US Dollar Strength: The US dollar has been displaying strength in the global markets, making gold more expensive for holders of other currencies and potentially limiting demand. The inverse relationship between the US dollar and gold prices is a well-established dynamic in the financial markets.

- Rising Bond Yields: Higher bond yields can make fixed-income investments more attractive compared to non-yielding assets like gold. As bond yields rise, the opportunity cost of holding gold increases, which can lead to a decrease in demand and, consequently, lower prices. The real interest rate has a negative correlation with gold prices, as higher real rates make gold less appealing.

- Inflation Concerns: Investors are closely monitoring inflation data to gauge the potential impact on gold prices. Gold is often considered a hedge against inflation, as it tends to maintain its value over time. The upcoming release of the US core PCE inflation data, the Federal Reserve’s preferred inflation gauge, is expected to provide valuable insights into the current inflationary environment.

- Federal Reserve Commentary: Market participants are eagerly awaiting comments from Federal Reserve officials regarding the future trajectory of US interest rates. Any hints about the timeline for potential rate cuts could significantly impact gold prices, as lower interest rates generally support gold by reducing the opportunity cost of holding non-yielding assets.

Market Expectations and Trading Strategies

As traders and investors navigate the current market conditions, they are focusing on several key aspects:

- US Core PCE Inflation Data: The upcoming release of the US core PCE inflation data is expected to provide crucial insights into the inflationary pressures in the economy. Traders are closely monitoring this data to assess the potential impact on gold prices and adjust their trading strategies accordingly.

- Federal Reserve Comments: Any comments from Federal Reserve officials regarding the future path of interest rates will be carefully scrutinized by market participants. Hints about the timing of potential rate cuts could significantly influence gold prices, as lower rates tend to support the precious metal.

- Technical Analysis: Traders are employing various technical analysis tools to identify key support and resistance levels, as well as potential entry and exit points in the gold market. Analyzing historical price charts, such as those spanning the past 1 day, 3 days, 30 days, 60 days, 1 year, 2 years, 5 years, 10 years, 15 years, 20 years, 30 years, and up to 43 years, can provide valuable insights into long-term trends and market dynamics.

- Risk Management: Given the current market volatility, traders are placing a strong emphasis on risk management strategies. This includes setting appropriate stop-loss orders, managing position sizes, and diversifying their portfolios to mitigate potential losses. Prudent risk management is crucial in navigating the uncertainties surrounding gold prices.

Implications for Forex Traders

For forex traders, the fluctuations in gold prices can have significant implications, particularly when trading currency pairs that are sensitive to changes in the precious metal’s value. Some key considerations for forex traders include:

- USD/XAU Correlation: The US dollar and gold often exhibit an inverse relationship, with a stronger dollar typically leading to lower gold prices and vice versa. Forex traders should closely monitor the USD/XAU pair and consider the impact of gold price movements on their trading strategies.

- Risk Sentiment: Gold is often considered a safe-haven asset, attracting investors during times of economic uncertainty or market turbulence. Changes in risk sentiment can influence gold prices and, consequently, impact forex markets. Traders should stay attuned to shifts in market sentiment and adjust their positions accordingly.

- Commodity Currencies: Currencies of countries with significant gold reserves or mining operations, such as the Australian dollar (AUD), Canadian dollar (CAD), and South African rand (ZAR), can be influenced by fluctuations in gold prices. Forex traders should consider the potential impact of gold price movements on these commodity currencies.

- Inflation and Interest Rates: As gold is often viewed as a hedge against inflation, changes in inflation expectations and interest rate decisions by central banks can affect gold prices and, in turn, impact forex markets. Traders should closely follow economic data releases and central bank communications to gauge the potential implications for gold and currency pairs.

Summary

As gold prices hover around the $2,334 per ounce level, traders and investors are closely monitoring various factors that could influence the precious metal’s future trajectory. The strong US dollar, rising bond yields, upcoming inflation data, and comments from Federal Reserve officials are all key elements that market participants are considering in their decision-making process.

For forex traders, understanding the relationship between gold prices and currency markets is crucial in developing effective trading strategies. By staying informed about economic developments, analyzing historical price charts, and employing prudent risk management techniques, traders can navigate the current market conditions and potentially capitalize on opportunities presented by fluctuations in gold prices.

As always, it is essential for traders to conduct thorough research, stay updated with the latest market news, and exercise caution when making trading decisions. By combining a deep understanding of market dynamics with disciplined trading practices, forex traders can position themselves to effectively navigate the challenges and opportunities presented by the ever-changing financial landscape.